Investing can be a complex journey, and one of the first decisions an investor faces is choosing between stocks and bonds. These two financial instruments offer distinct ways to participate in the market, each with its own set of risks and rewards. In this article, we’ll delve into the key differences between stocks and bonds, examining their structures, how they generate income, their tax implications, and the unique role each plays in a diversified investment portfolio.

Stocks: Ownership and Growth

When you invest in stocks, you become a partial owner of the company. Essentially, you’re buying shares, and the more shares you own, the greater your ownership stake. As the company prospers, so does the value of your shares. Conversely, if the company struggles, the value of your shares may decrease. The primary way stocks generate income is through capital gains – selling shares at a higher price than the purchase cost.

Stocks, also known as equities, represent a form of ownership in a company and are often issued to the public to raise capital for future growth. While stocks can provide substantial returns, they come with higher volatility and risk compared to bonds.

Bonds: Loans and Fixed Income

In contrast, bonds involve lending money to a company or government. When you buy a bond, you’re essentially providing a loan, and in return, the issuer pays you fixed interest over a set period. Unlike stocks, bonds don’t confer ownership rights, but they offer a predictable stream of income. Bonds are considered debt instruments, and their value is tied to the issuer’s ability to repay the principal and interest.

The duration of bonds varies, ranging from a few days to several decades. Interest rates, known as yield, are determined by the type and duration of the bond. Investors often appreciate the stability and fixed income provided by bonds, making them a popular choice for risk-averse individuals.

Comparing Stocks and Bonds

- Equity vs. Debt: The distinction between stocks (equity) and bonds (debt) lies in the nature of the financial instrument. Stocks offer ownership and participation in a company’s success, while bonds involve lending money with the expectation of regular interest payments and the return of the principal amount.

- Capital Gains vs. Fixed Income: Stocks generate income through capital gains, realized by selling shares at a higher price. Bonds provide fixed income through regular interest payments, offering stability and predictability over time.

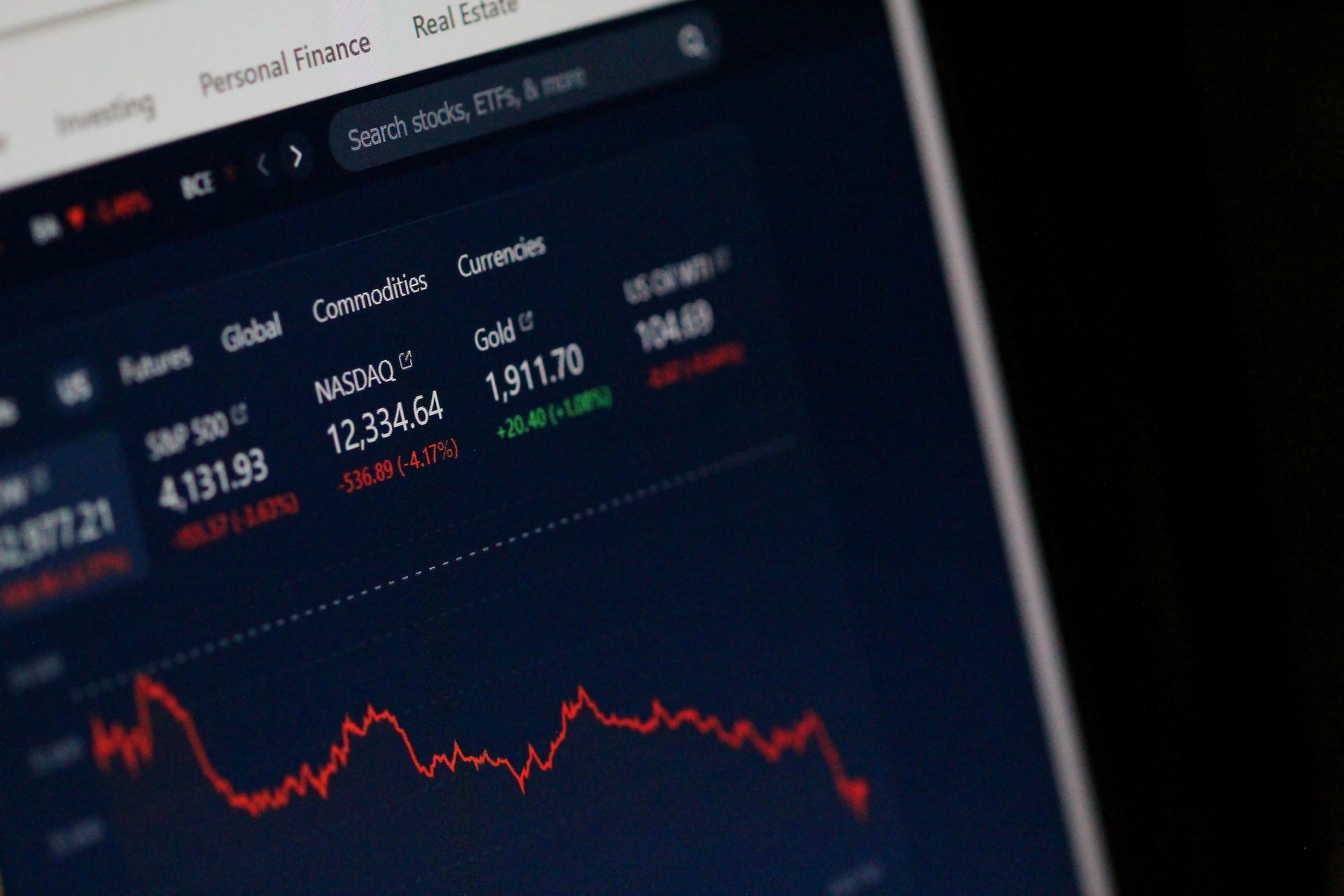

- Inverse Performance: Stock and bond prices often have an inverse relationship. When stock prices rise, bond prices tend to fall, and vice versa. Economic factors, investor behavior, and interest rates contribute to this dynamic.

- Taxes: Stocks and bonds are taxed differently. Bond interest payments are typically subject to income tax, while profits from selling stocks are subject to capital gains tax. Certain bonds, such as municipal bonds and Treasury bonds, may have tax exemptions.

Risks and Rewards

- Stock Risks: Stocks come with the risk of share value decreasing due to various factors affecting a company’s performance. However, higher risk can lead to higher returns, with the stock market historically offering an average annual return of around 10%.

- Bond Risks: While U.S. Treasury bonds are relatively stable, corporate bonds carry varying levels of risk based on the issuer’s credit rating. Investment-grade bonds have lower risk and returns, while high-yield bonds (junk bonds) offer higher risk and potential returns.

- Allocation in Portfolios

- Diversification: A well-balanced investment portfolio often includes a mix of stocks and bonds to manage risk. The allocation may be determined by factors such as age, risk tolerance, and investment goals.

- Debates on Allocation: Traditional guidelines suggest allocating a percentage of stocks equal to 100 minus one’s age. However, detractors argue for more aggressive allocations, considering longer lifespans and the availability of low-cost index funds.

- The Upside Down: Some stocks offer fixed-income benefits similar to bonds, such as dividend-paying stocks. Preferred stocks, considered a hybrid between stocks and bonds, provide fixed income through dividends.

In the realm of investments, choosing between stocks and bonds is not about one being superior to the other; rather, it’s about understanding their distinct roles and how they fit into an overall investment strategy. Both stocks and bonds offer unique advantages and risks, and a well-informed investor may find that a combination of the two provides the optimal balance for their financial goals. As with any investment decision, thorough research, consideration of individual circumstances, and consultation with financial professionals are crucial steps in building a resilient and rewarding portfolio.